Joe Terranova is the chief market strategist for Virtus Investment Partners, a position he was elevated to in 2009, after having started with the firm as chief alternatives strategist. In his current role, Mr. Terranova is involved with Virtus’ investment oversight function and represents Virtus as a client-facing thought leader, providing insight into the domestic and global investing landscape.

Mr. Terranova developed the Terranova US Quality Momentum Index (VTUSQM) which launched and began publicly pricing in August 2020. The index methodology, which seeks to provide systematic exposure to domestic large-cap companies exhibiting both quality and momentum characteristics, reflects the investing principles he has utilized to assess markets throughout his career.

Prior to joining Virtus in 2008, Mr. Terranova spent 18 years at MBF Clearing Corp., rising to the position of director of trading for the company and its subsidiaries. In this capacity, he managed more than 300 traders and support staff for MBF, one of the New York Mercantile Exchange’s largest firms. His work was highlighted as the feature story in the June 2004 issue of Futures magazine.

Mr. Terranova is perhaps best known for his risk management skills, honed while overseeing MBF’s proprietary trading operations during some of the most calamitous times for the U.S. markets, including the first Gulf War, the 1998 Asian Crisis, 9/11, and the collapse of Amaranth Advisors. In 2003, he was one of the first Wall Street professionals to make an early call for higher energy, natural resources, and commodity prices. In June 2008, he cautioned investors to move to the sidelines in commodities and, in March 2009, he encouraged investors to ignore the global “embracement of pessimism” and overweight equities. Before joining MBF, Mr. Terranova held positions at both Swiss Banking Corp. and JP Morgan Securities.

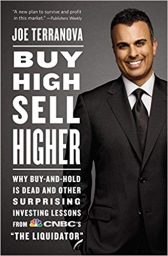

Since 2008, Mr. Terranova has been a CNBC ensemble member, appearing regularly on the Halftime Report, Squawk Box, and as a contributor of financial content across CNBC’s media and digital platforms. He is the author of “Buy High, Sell Higher” (Business Plus, 2012), based on his years as a professional trader.

Questions? Contact Us Any Time:

805.965.1400

info@bigspeak.com

Mr. Terranova is strongly committed to charitable causes benefiting children. He founded and funds the 501(c) South Nassau Rock organization, which provides specialized athletic experiences for children, and works with Nassau County to sponsor the improvement of baseball and outdoor ice rink facilities. In 2007, he established “Bossy’s Bunch,” a program that rewards academic excellence among elementary school students, with New York Islanders Hall of Fame hockey player Mike Bossy. In 2013, he expanded his charity work with the Islanders, creating and sponsoring the “Courier of Courage” program, which acknowledges children who have overcome hardships, disabilities, or illness. He is also a supporter of the Islanders Children’s Foundation and Smile Train.

Mr. Terranova earned a bachelor’s degree in finance from the Peter J. Tobin College of Business at St. John’s University in New York.